Federal Reserve’s Aggressive Rate Cut: A Strategic Move or a Sign of Concern?

The U.S. Federal Reserve’s recent decision to cut rates by 50 basis points, bringing the federal funds rate to 4.75-5.00%, marks a significant shift in monetary policy, aimed at preempting economic slowdowns and supporting employment. Here’s a detailed look at what this means for the economy, investors, and consumers.

Why the Fed Opted for a 50 Basis Point Cut

- Preemptive Strike Against Economic Downturn: Despite not being in a recession, signs of economic stress have prompted the Fed to act decisively. This move was somewhat anticipated by markets, aligning with expectations reflected in platforms like X where economic discussions hinted at a significant rate adjustment.

- Market and Economic Reactions:

- Currency Dynamics: The immediate aftermath saw a weakened USD, which could boost U.S. exports by making them cheaper on the global market but might increase the cost of imports.

- Investment and Savings: Lower rates typically encourage borrowing and spending over saving, potentially stimulating economic activity. Gold prices, often seen as a safe-haven investment, reacted positively to the news.

Looking Ahead: What This Means for the U.S. Economy

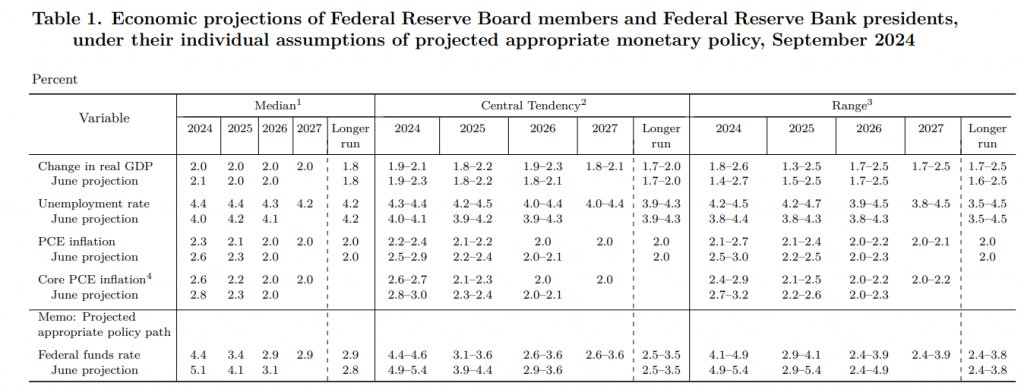

- Inflation and Employment: While the Fed’s statements reflect confidence in moving inflation towards the 2% target, there’s a nuanced view on employment. Fed Chair Jerome Powell emphasized the commitment to maximum employment, suggesting a nuanced approach where rate cuts are not just about combating inflation but also about sustaining job growth.

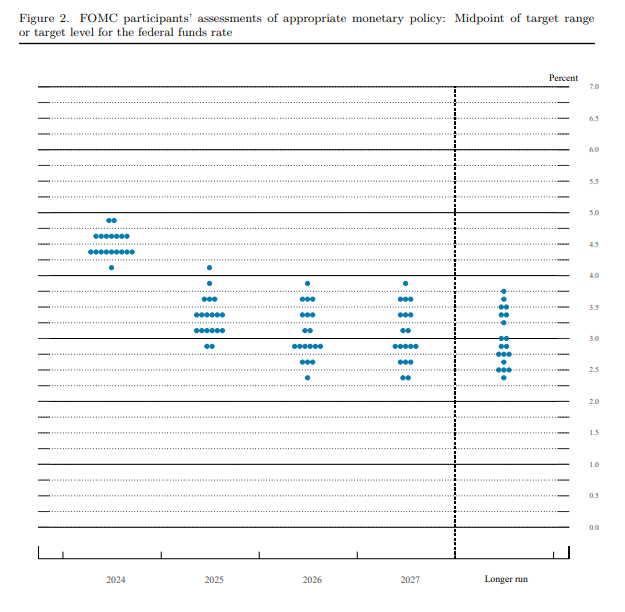

- Future Rate Adjustments: The Fed’s Summary of Economic Projections suggests further easing, but Powell’s commentary indicates no rush into continuous large cuts, emphasizing a data-dependent approach. Investors and analysts will watch employment data closely, as this will be pivotal in future rate decisions.

- Economic Projections and Market Sentiment: The rate cut has mixed implications for the stock market. Historically, initial rate cuts can lead to stock market gains, but this is not guaranteed, especially if economic indicators start pointing towards a recession.

Implications for Consumers and Businesses

- Loan Rates: This cut could lead to lower interest rates on loans, making it cheaper for consumers and businesses to borrow, potentially spurring investment and consumption.

- Savings Accounts: Conversely, returns on savings accounts and CDs might decrease, pushing investors to seek higher yields elsewhere, possibly fueling stock market investment or real estate.

- Global Economic Impact: A lower federal funds rate might affect global trade dynamics, with a potentially weaker dollar affecting international trade balances and possibly leading to competitive rate adjustments by other central banks.

Conclusion: Navigating the New Economic Landscape

The Fed’s decisive action underscores a commitment to economic stability but also opens up discussions on long-term effects, like potential inflation risks or asset bubbles due to cheap money. For now, this rate cut serves as both a shield against economic downturns and a stimulus for growth. Investors, businesses, and consumers alike should prepare for a period of adjustment, keeping an eye on economic indicators and Fed communications for clues on future monetary policy directions. This environment might offer opportunities for those ready to adapt to the evolving economic landscape shaped by these aggressive monetary policy moves.