«Explore the implications of Canada’s inflation rate dropping to 2.0% in August 2024, and how it could affect monetary policy and your financial decisions.»

Canada’s Inflation Cools Down to the Target Rate

In a significant economic update, Canada’s Consumer Price Index (CPI) inflation has decreased to 2.0% in August 2024, aligning with the Bank of Canada’s (BoC) inflation target. This adjustment from July’s 2.5% has beaten economic predictions of a slight dip to 2.1%, marking a pivotal moment for economic policy in Canada.

Key Factors Behind the Inflation Drop

- Cheaper Gasoline: A major contributor to this decline was the decrease in gasoline prices, affected both by current market prices and comparison with the previous year.

- Month-over-Month Change: Notably, inflation dropped by 0.2% from July to August, defying expectations of no change, showcasing an unexpected deflationary trend.

- Core Inflation Measures: The BoC’s favored inflation metrics, CPI Median and CPI Trim, also indicated a slowdown, suggesting broad-based easing in inflation pressures, with the average core inflation rate now at 2.35%.

What This Means for Monetary Policy

- Rate Cut Speculations: With inflation at target, discussions around the BoC’s next moves are heating up. Terms like «Bank of Canada rate decision» and «monetary policy easing» are vital for SEO, capturing audiences interested in economic forecasts.

- Market Expectations: Following the inflation report, markets are pricing in significant chances of rate cuts, potentially influencing Canadian dollar trends and investment strategies.

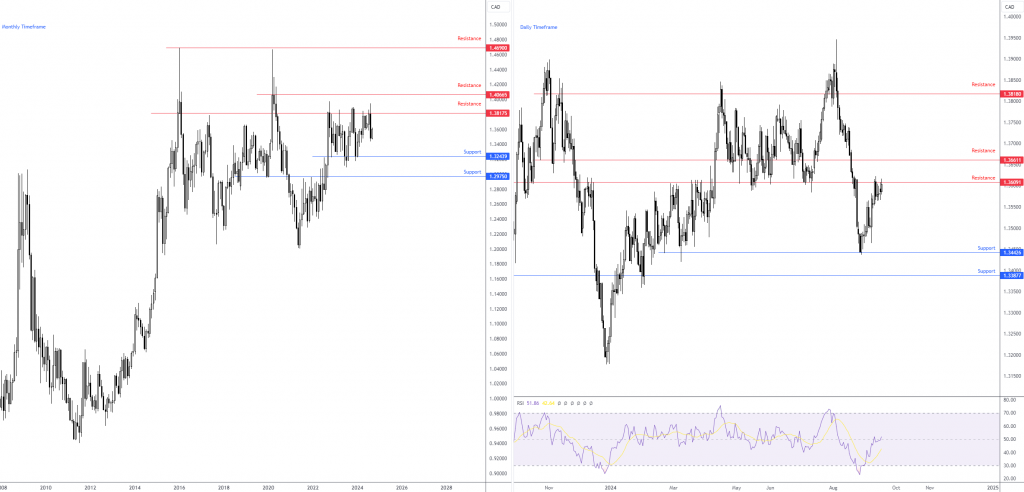

Impact on USD/CAD Exchange Rate

- Currency Dynamics: The USD/CAD has been oscillating within a defined range, with key resistance and support levels influencing trader behavior. Mentioning these levels with terms like «USD/CAD resistance» and «Quasimodo support» can attract forex traders and enthusiasts.

- Potential for Upward Movement: With the RSI indicating positive momentum, there’s SEO potential in discussing possible breakouts above resistance levels, targeting terms like «USD/CAD