BlackBerry’s Stock in Decline: A Closer Look Before Earnings

Is BlackBerry Facing a Continued Stock Decline? Here’s What Investors Should Know Before Earnings

As the tech sector braces for another round of earnings, BlackBerry Limited (BB) is under the spotlight with its earnings report due after the market closes on September 26, 2024. With analysts predicting an EPS of -$0.04 for the fiscal quarter ending August 2024, against last year’s -$0.06, the looming question is whether BlackBerry’s Stock in Decline: A Closer Look Before Earnings will reveal a turnaround or further descent.

Understanding BlackBerry’s Market Position

- Earnings Expectations: The slight improvement in expected EPS might suggest a cautious optimism, but investors are keen to see if BlackBerry can capitalize on its strategic shifts towards cybersecurity and IoT.

- Market Sentiment and Stock Performance: Recent discussions highlight a complex picture. On one hand, there’s an acknowledgment of a decline in stock value, with some investors debating the severity of this drop when viewed through different time lenses. On the other, there’s curiosity about whether this decline positions BlackBerry as an undervalued tech play, potentially at the cusp of a new growth cycle.

Technical Analysis Insights

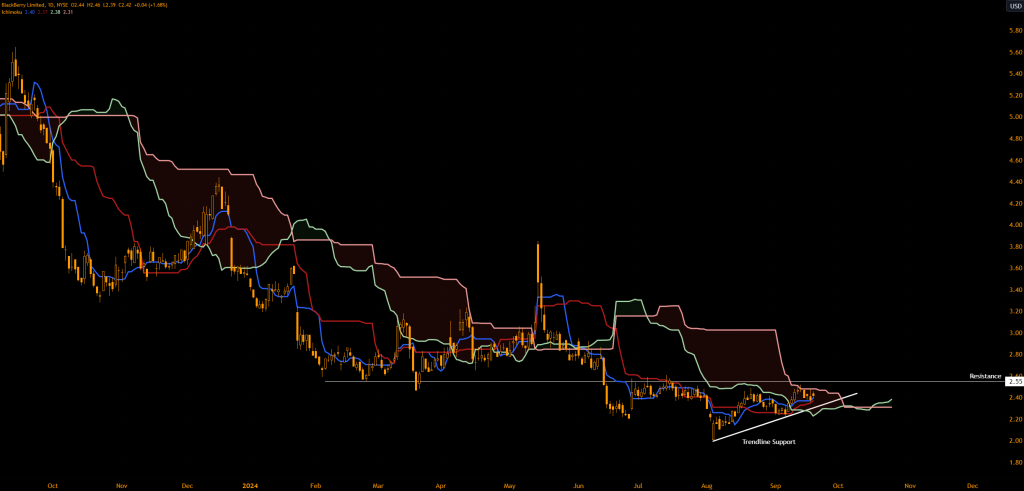

- Ichimoku Cloud and Trendlines:

- Current Price Action: After reaching a year-to-date low of $2.01 in early August, BlackBerry’s stock price has been testing the resilience of the Ichimoku Cloud’s upper boundary, suggesting areas where sellers might regroup.

- Bullish and Bearish Signals: While the overarching trend shows lower highs and lows, suggesting a sell-on-rally approach, the Ichimoku indicators are sending mixed signals. The Conversion Line surpassing the Base Line could hint at underlying bullish momentum, although it’s juxtaposed with the stock’s struggle against key resistance levels at $2.55.

- Resistance and Support Dynamics:

- $2.55 Resistance: This level is critical. A break above could trigger short covering or indicate a shift in market sentiment. Conversely, failure to breach this could reinforce the downtrend.

- Support Trendline: The ascending trendline from the low of $2.01 remains a pivotal line. A break below might signal to sellers that it’s time to increase positions or for new sellers to enter, potentially accelerating the decline.

Conclusion

As BlackBerry approaches its earnings date, the combination of fundamental analysis with technical indicators provides a nuanced view for investors. While the stock’s decline is evident, the mixed signals from the Ichimoku studies suggest that traders and long-term investors should closely watch post-earnings reactions for signs of either a rebound or a confirmed continuation of the downtrend.

For those looking to analyze BlackBerry’s stock before earnings, keeping an eye on these technical levels and understanding broader market sentiment will be key to navigating the potential volatility that earnings announcements often bring.