Unlocking PepsiCo’s Potential: Earnings Insight & Technical Analysis

As PepsiCo, Inc. (PEP) gears up to announce its earnings on October 8, 2024, investors and traders are keenly watching. With the market opening, all eyes are on whether PepsiCo will meet or exceed the consensus earnings per share (EPS) estimate of US$2.30, up from last year’s US$2.25 for the same fiscal quarter.

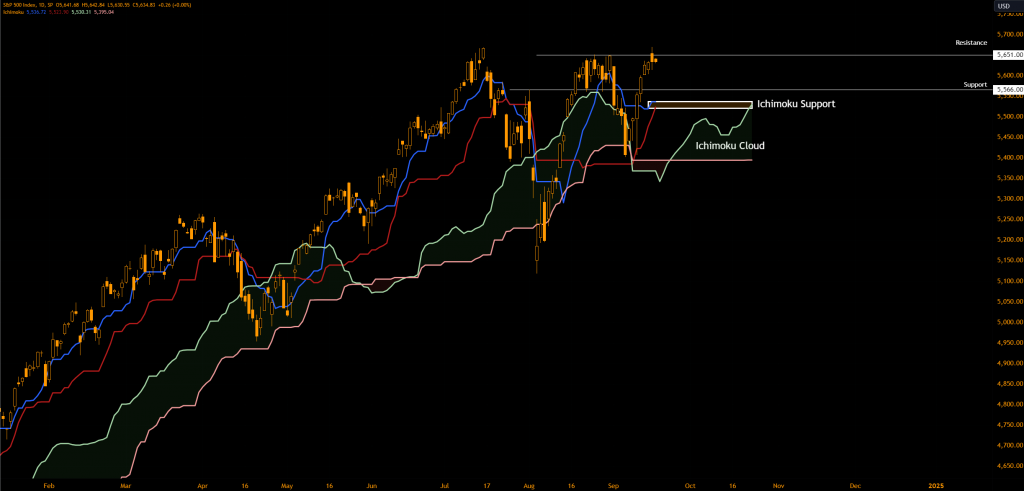

Navigating the Ichimoku Cloud:

Pepsi’s stock price has recently crossed above both the Conversion Line (US$170.47) and Base Line (US$171.01) of the Ichimoku indicator, signaling potential bullish momentum. However, the looming Ichimoku Cloud presents a significant resistance zone between US$170.74 and US$173.99. This cloud not only represents psychological resistance but also coincides with key Fibonacci levels, particularly around US$173.00, where a Fibonacci cluster indicates a strong resistance area.

Price Dynamics and Investment Strategy:

Ahead of the earnings report, PepsiCo’s stock might test this resistance. Investors should watch for the stock’s ability to break through the Ichimoku Cloud, especially around the Fibonacci convergence at US$173.00. Given the slowed momentum since March, traders might consider tight risk management strategies, reducing positions to breakeven if the stock fails to push through this critical resistance.

Stay Ahead with PepsiCo’s Earnings:

Will PepsiCo break through the technical barriers, or will it succumb to the overhead cloud? Stay tuned for an insightful breakdown post-earnings to adjust your investment strategy in line with PepsiCo’s financial health and market trends.